“Elevated interest rates and low housing supply have kept many prospective borrowers on the sidelines,” said Edward Seiler, associate vice president of housing economics at MBA and executive director of Research Institute for Housing America. “However, MBA expects mortgage rates to stabilize and inventory levels to improve, which should incentivize some buyers to re-enter the market.”

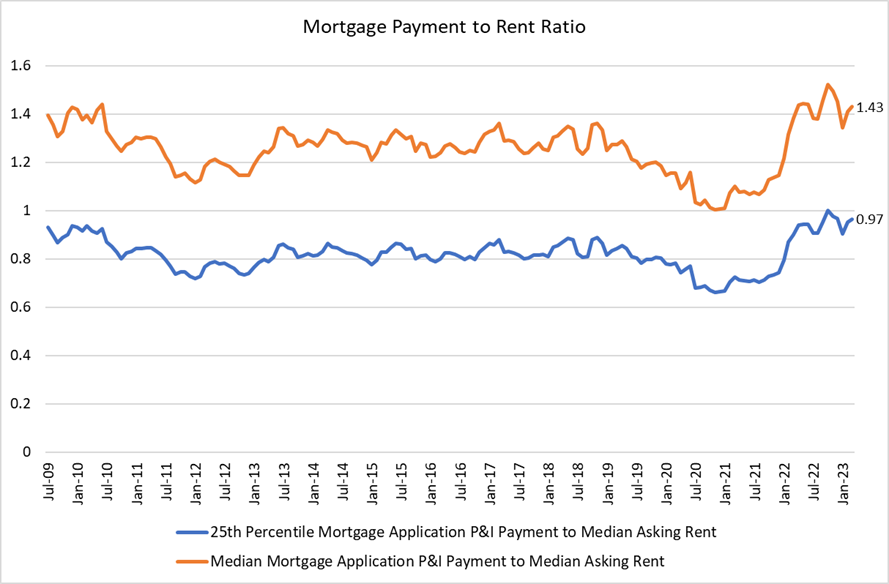

Meanwhile, the national mortgage-payment-to-rent ratio decreased to 1.43 at the end of the first quarter, from 1.45 in the previous quarter. This means mortgage payments for home purchases have decreased relative to rent.

According to the Census Bureau, the median asking rent increased 10.5% quarter over quarter to $1,462. The 25th percentile mortgage application payment to median asking rent ratio plateaued at 0.96 in March.

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.