The report started off by noting that interest in multifamily assets on Ten-X had not flagged. On the contrary, page views on multifamily properties posted on Ten-X had surged by almost 50% from the first quarter of last year, hitting “new heights” for the platform. While multifamily-property shopping was on the rise, however, a gulf was forming between what Ten-X termed as buyers’ skepticism and sellers’ optimism. Buyers were expecting to see more affordable prices – which in turn informed their underwriting of property values – while multifamily property sellers hesitated to adjust their expectations.

“What we’re seeing on Ten-X is not that investors are backing away from investing, but they are being more conservative,” Jacobs said.

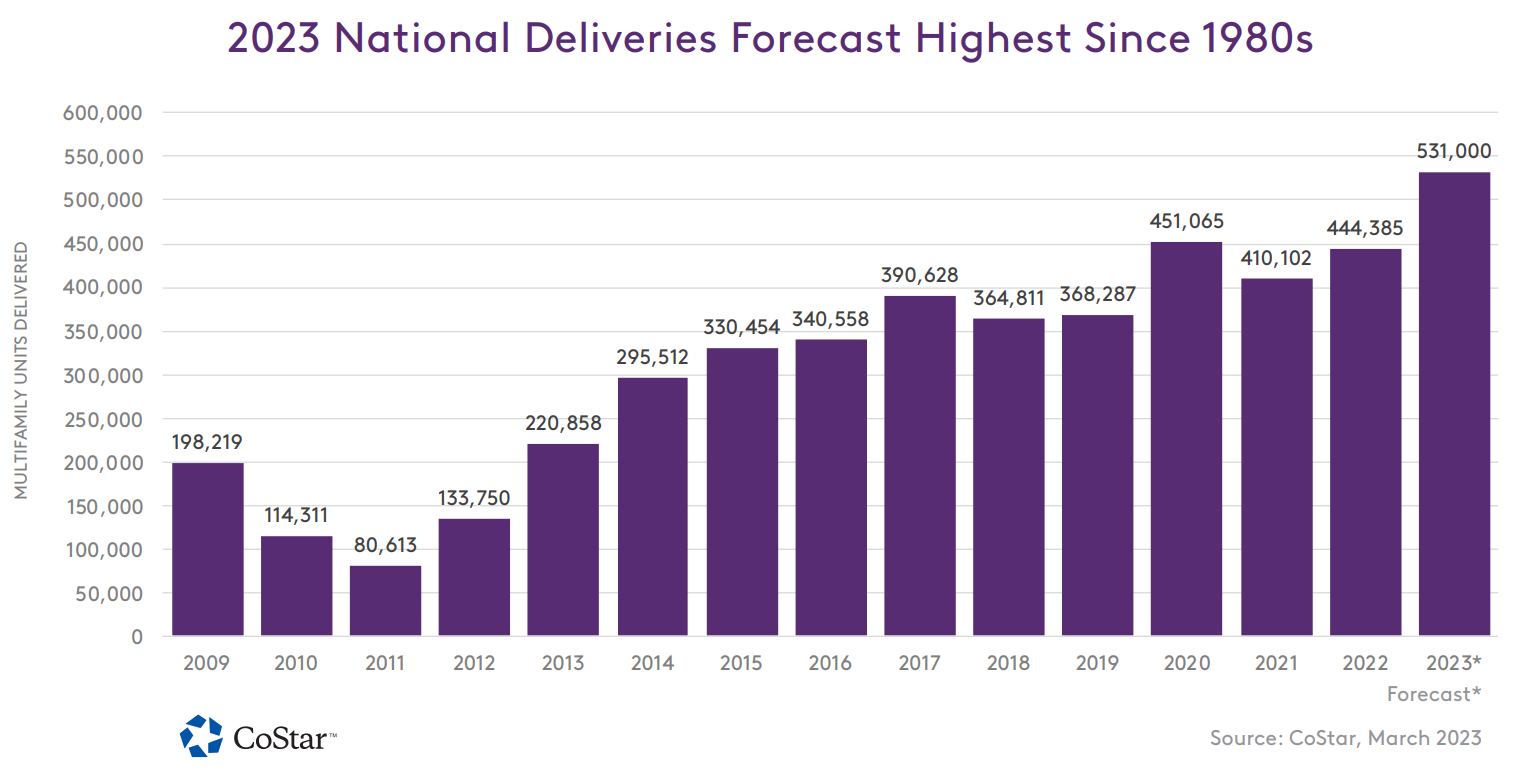

A Costar multifamily analytics assessment revealed a number of factors driving investor caution on the multifamily property front. For one, rising interest rates were generally making the acquisition of new properties more expensive than before. In addition, investors were expecting to face two things: a historical wave of loan maturities becoming due over the next three years, and an influx of new supply later this year – expected to be the highest volume of additional housing stock since the 1980s, Ten-X reported.

Multifamily sector supply had already outstripped demand for the sixth quarter in a row earlier this year.