News & Articles

Mortgage application decline continues amid economic turmoil

Application volume for mortgage loans declined for the third consecutive week against an increasingly cloudy economic backdrop, the Mortgage Bankers Association reported today. MBA’s Market Composite Index, a measure of mortgage applications, slumped 3.7% on a...

House price downturn comes to an end

The year-over-year house price index also rose modestly, up 0.7% in March. The acceleration was apparent in many Western states. “The CoreLogic S&P Case-Shiller Index squeezed a 0.7% year-over-year increase in March. But, monthly gains, up 1.3% from February, are...

UBS Group to close US mortgage trading unit

Read next: Not all bank failures are the same, broker says People familiar with the decision told Bloomberg the exact number of workers affected by the move is unclear, but the unit’s managing director, Michael Sudnow, is among those leaving the bank. “We are fully...

AAG loses reverse mortgage leader to Smartfi Home Loans

Smith started her career in 2004 as regional manager of wholesale sales at Financial Freedom. After that, she helped One Reverse Mortgage develop a successful sales team as senior vice president of wholesale lending. “I am so excited to announce I have joined the...

loanDepot names new chief marketing officer

loanDepot has named company veteran Alec Hanson (pictured) as its new chief marketing officer, effective immediately. The lender promoted Hanson, previously senior vice president of production for the West division, to lead its marketing team and oversee the...

Time is ripe for non-QM lenders to expand

Time is ripe for non-QM lenders to expand | Mortgage Professional TV [embedded content] LATEST NEWS Free e-newsletter Our daily newsletter is FREE and keeps you up to date with the world of mortgage. This page requires...

Broker knows what it is to lose it all

Back to square one It was time to rebuild. “I did a little sabbatical for about a year in New Mexico,” he said. “I had to live with my parents, and they helped me with my kids. I had four kids. They crashed with me. We all crashed together!” he said, now able to laugh...

Movement Mortgage duo take on expanded roles

Before joining Movement, Koss served as executive vice president at Mortgage Network, while Hayes was senior vice president of residential lending. “I am grateful for the opportunity to continue to work with Ryan, a rising star in the industry, and to be part of the...

Ellington Financial to enter billion-dollar merger

Penn added that this acquisition will result in greater operating efficiencies, a larger market capitalization, and attractive long-term unsecured debt and preferred equity capital. Read more: Ellington Residential Mortgage REIT publishes Q4 financial report “Upon...

US housing crash – how likely is it?

Apparently, there’s not even so much as a bubble in today’s market. Len Kiefer, deputy chief economist at Freddie Mac, recently explained to Forbes why the US housing market is not currently encased in such a bubble. “A bubble has three defining characteristics: price...

United Wholesale Mortgage boosts jumbo loan product suite

The wholesale mortgage lender has also expanded its Conventional 1% Down product, allowing borrowers with less than 80% of the area median income (AMI) to qualify. Eligible borrowers will put down 1% of the loan towards their down payment, and UWM will then pay a 2%...

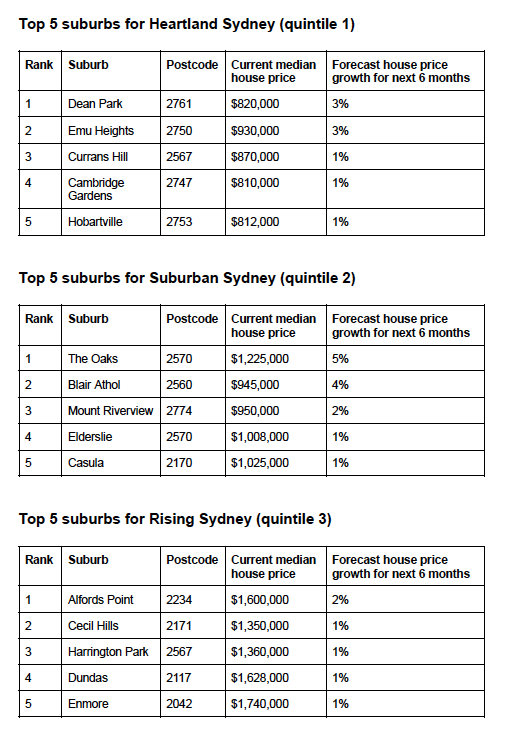

Revealed: Where Sydney house prices are set to grow

Revealed: Where Sydney house prices are set to grow | Mortgage Professional News Report reveals the top areas across more than 600 suburbs By Mina Martin 29 May 2023 A select number of suburbs in Sydney are tipped to record price growth in the next six months to...