by mdibrino@hqmloans.com | May 23, 2023 | Uncategorized

The 1% down payment program was designed specifically to serve millions of Americans from low to moderate income-level households struggling with housing affordability. Homebuyers whose income added up to 80% or less than their area median income (AMI) and who were...

by mdibrino@hqmloans.com | May 23, 2023 | Uncategorized

Census figures suggest a rebound in housing activity And yet, hope appears to be on the horizon – starting in July anyway. Joel Kan, MBA’s vice president and deputy chief economist, echoed Broeksmit’s assessment on the impact of the higher mortgage rates, noting they...

by mdibrino@hqmloans.com | May 23, 2023 | Uncategorized

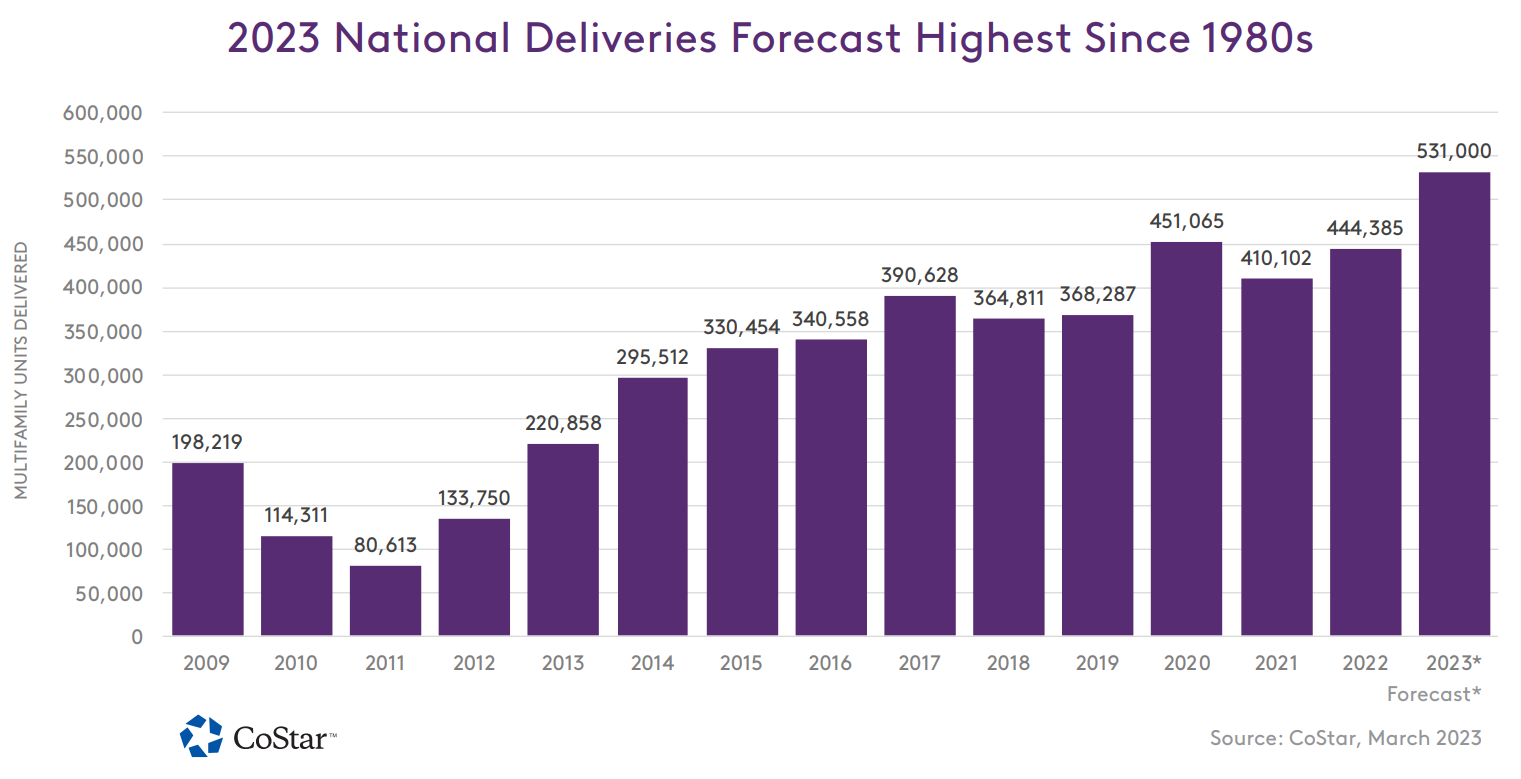

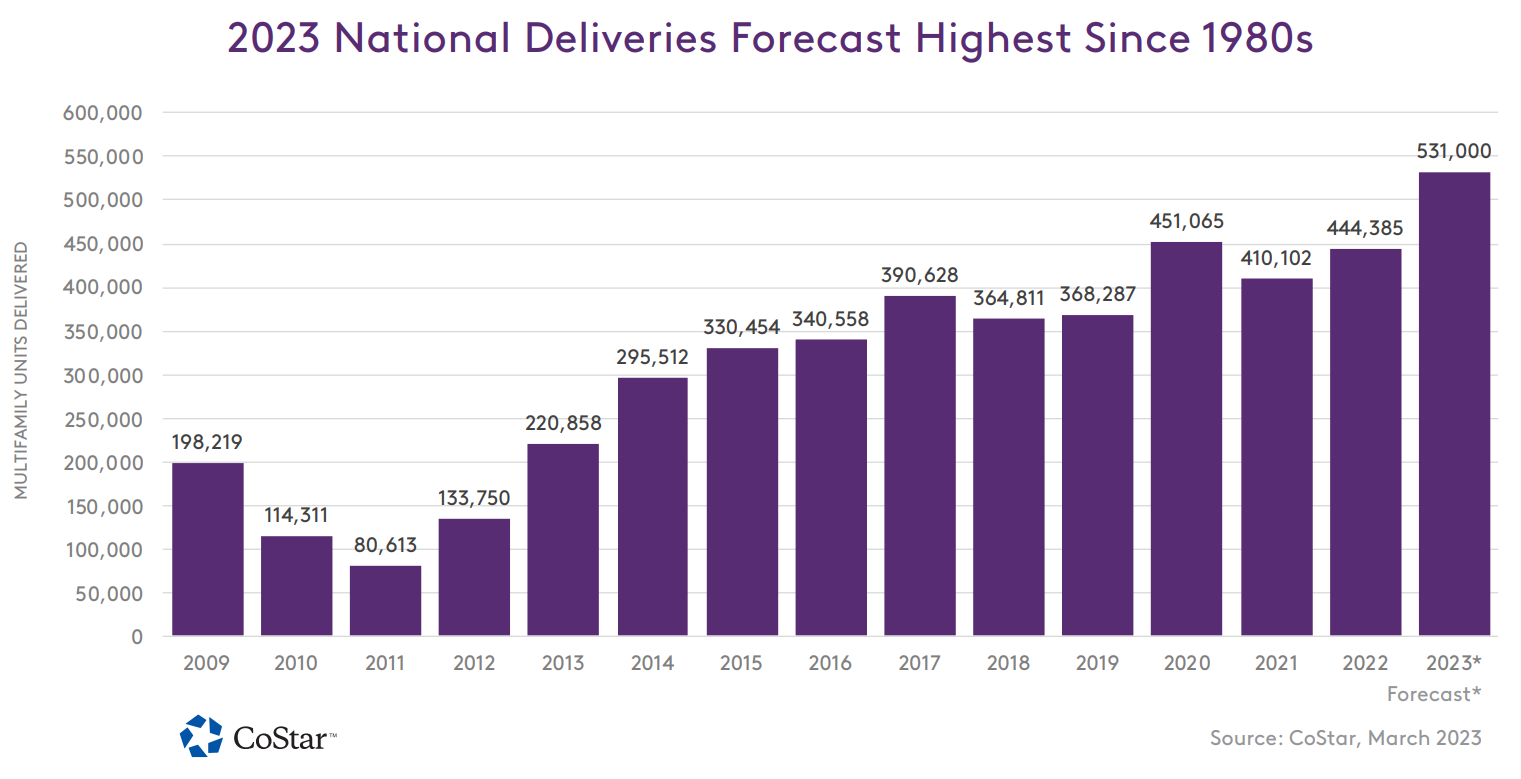

The report started off by noting that interest in multifamily assets on Ten-X had not flagged. On the contrary, page views on multifamily properties posted on Ten-X had surged by almost 50% from the first quarter of last year, hitting “new heights” for the platform....

by mdibrino@hqmloans.com | May 22, 2023 | Uncategorized

What once was certain is now up for debate From there, the waters are further muddied: “However, the NBER also says there is ‘no fixed rule about what measures contribute information to the process or how they are weighted in our decisions,’ Investopedia reported....

by mdibrino@hqmloans.com | May 22, 2023 | Uncategorized

Planet Financial Group has launched a loan servicing division targeting the commercial lending market. Planet’s new division will deliver a wide range of tools and services, spanning automated payment processing, detailed asset and financial tracking, investor...

by mdibrino@hqmloans.com | May 22, 2023 | Uncategorized

Notably, housing’s performance stands out as a leading indicator, presenting a mixed picture of the overall economic outlook. Read next: Mortgage rates could soar by 22% if U.S. defaults on debt – Zillow “Housing remains exhibit number one for why we expect the...